Today in this modern world Credit Card is playing a huge role in our life. Let us know Credit Card and related information.

What is Credit Card

A credit card is a special kind of plastic card given by a bank. It lets you buy things even if you don’t have the money right away. You can borrow some money, but only up to a certain amount. This helps you get the things you want or need. It’s like an easy way to pay for stuff, whether you’re shopping in a store or online.

When you use a credit card, you’re actually borrowing money from the bank that gave you the card. But remember, you have to give that money back later within stipulated time as per your bill cycle. Usually, you have to pay back a little bit of the money every month. After a while, the bank sends you a statement that lists all the things you bought and how much money you owe them. It’s important to pay at least a certain amount every month so that your account stays in good shape but it is always advisable to pay all the amount due just to avoid any interest.

Credit cards are pretty useful. They let you do important things like build a good money history, get rewards or cash back when you buy things, and have some extra money in case of emergencies. Just be careful with credit cards. Using them the right way is important so that you don’t end up owing too much money or having to pay extra fees. To be specific using credit card is very good if it is used wisely and if not it may impact badly.

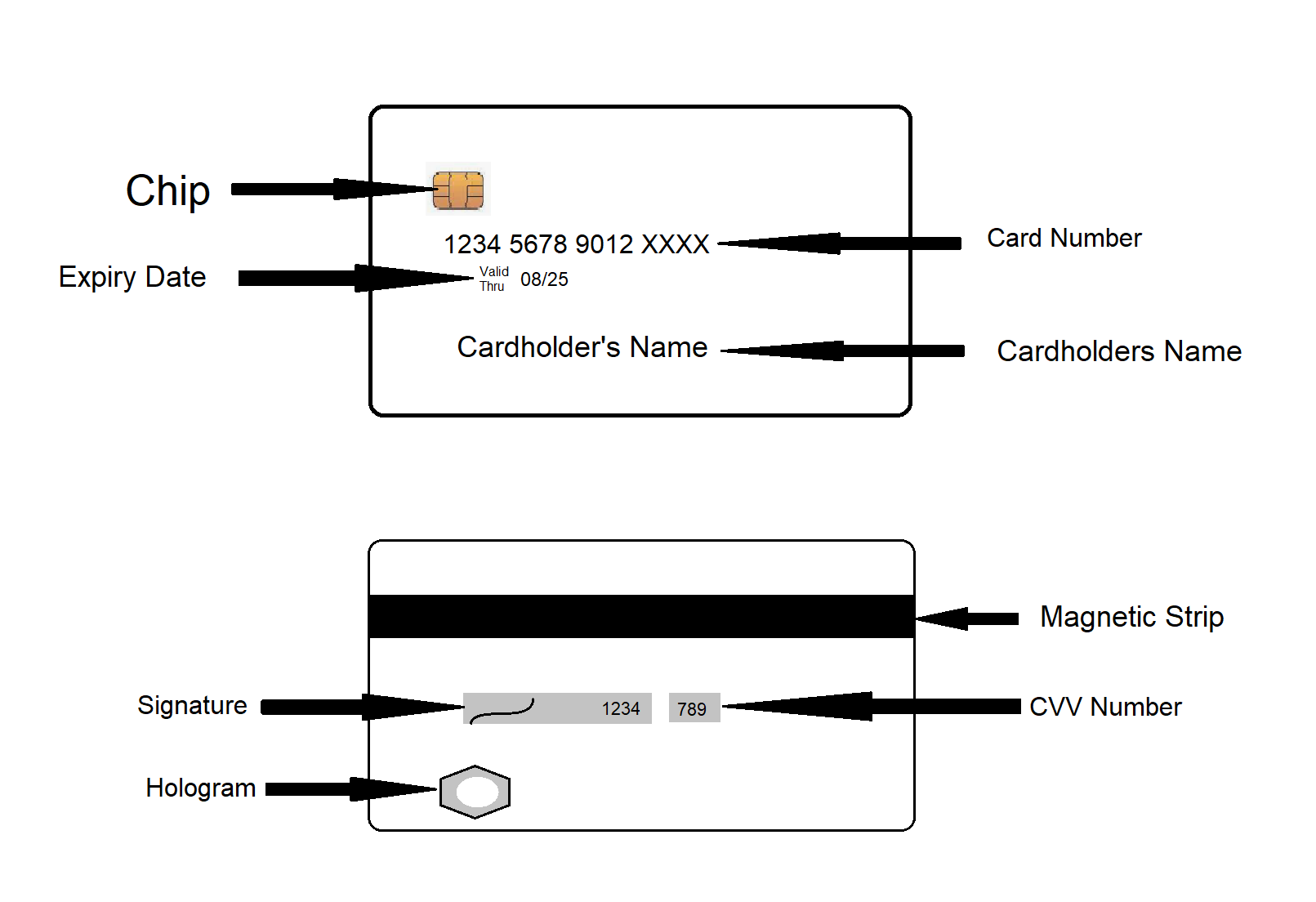

Below Diagram is the structure of credit card.

Key Points of credit Card:

Credit cards usually make you pay more interest every year compared to other types of loans.

- If you don’t pay back the money you owe on the card, you have to pay extra money called interest. This starts about a month after you buy something with the card. But sometimes, when you first get the card, there’s a special time when you don’t have to pay extra money for a while (this is called a 0% APR introductory offer). But if you still owe money from the month before, you don’t get extra time to avoid paying interest for new things you buy.

- According to the law, the companies that give you the credit card must give you at least 21 days to pay before they start charging you interest on what you bought. So, it’s a good idea to pay off what you owe before these 21 days are over.

- It’s also important to know if the company charges you interest every day or every month. If it’s every day, then you’ll have to pay more if you don’t pay off your balance quickly. This is really important to know if you want to move your credit card balance to a card with lower interest. If you switch from a card that charges interest every month to one that charges interest every day, you might not save money even if the interest rate is lower.

Types of Credit Cards:

There are several types of credit cards available to cater to different needs and preferences. Here are some common types:

Regular Credit Cards: These are simple credit cards that let you buy things and borrow money up to a certain limit set by the card company. A wide range of features and advantages are included.

Rewards Credit Cards: These cards offer rewards for using them, such as cash back, travel points, or discounts on specific purchases. Rewards can vary based on your spending habits and the card’s terms.

Travel Credit Cards: Designed for frequent travelers, these cards offer benefits like airline miles, hotel discounts, travel insurance, and airport lounge access.

Cash Back Credit Cards: These cards give you a percentage of the money you spend back as cash rewards. The cash back can be redeemed or used to reduce your credit card balance.

Balance Transfer Credit Cards: These cards allow you to transfer existing credit card debt to a new card with a lower or 0% interest rate for a limited period, helping you save on interest charges.

Secured Credit Cards: These are good for people with limited or poor credit history. A security deposit is needed, and that amount serves as your credit limit. They help you build or rebuild credit.

Student Credit Cards: Designed for students, these cards often have lower credit limits and offer features to help young adults learn responsible credit card usage.

Business Credit Cards: Geared towards business owners, these cards offer tools for managing expenses, tracking employee spending, and earning rewards on business-related purchases.

Retail Credit Cards: Issued by specific stores, these cards offer discounts, rewards, or special financing options for purchases made at that retailer.

Charge Cards: Unlike credit cards, charge cards require you to pay off the full balance each month. Usually, they have no defined spending cap.

Prepaid Credit Cards: These are not traditional credit cards. You load money onto the card, and you can only spend what you’ve loaded. They can be a good way to control spending and teach budgeting.

Low-Interest Credit Cards: These cards offer lower interest rates, which can be beneficial if you tend to carry a balance. They can help reduce the amount you pay in interest charges.

Luxury or Premium Credit Cards: These cards offer high-end perks like concierge services, luxury travel benefits, exclusive event access, and high credit limits. They often come with higher annual fees.

Build Good Credit History with Credit Cards

When used responsibly, different types of credit cards can help people improve their credit history and buy things online without using cash. These cards report payment and purchase information to credit agencies. This can lead to higher credit scores and the possibility of getting higher credit limits. People might start with a secured card and later switch to a regular card.

To build good credit history, it’s important to do a few things. These include paying on time, not being late on payments, not using too much of your available credit, and not having too much debt compared to your income. When you buy things responsibly and pay off what you owe promptly, your credit score will go up. This can make it easier to borrow money from other lenders in the future.

How to get a credit card first time?

Establishing a credit history can be a bit tricky. If you haven’t borrowed money before, it’s hard to convince banks to lend to you. One simple way to begin is by getting a secured credit card. With this type of card, you only spend the amount you’ve put as a deposit. It’s less risky for the lender and shows them how you handle money.

Another way to start building credit is by being added to someone else’s credit card account, like a parent or spouse. This adds their credit history to yours, making your credit report look longer. Just make sure the person you’re joining has good money habits. If they make poor financial choices, it can affect your credit too.

What is credit card limit

A credit card limit is the maximum amount of money that you’re allowed to borrow or spend using your credit card. It’s like a cap set by the credit card company on how much you can use the card for purchases, cash withdrawals, or other transactions. For example, if your credit card has a limit of $1,000, you can use the card to make purchases or withdrawals up to that amount. Going over this limit may result in fees or declined transactions. Your credit card limit is determined by factors like your credit history, income, and the credit card company’s policies.

Credit limit is decided and declared while issuing the card as per the applicant eligibility.

What are the major Credit Cards brand?

American Express, Discover, Mastercard, Visa and RuPay are the major credit card networks.

Which is the costliest credit card?

American Express is considered as the costliest credit card

Benefits of Credit Cards:

- Easy Spending Access: A credit card is like a promise to pay later. You can use it to buy things without using your bank balance right away.

- Credit History Building: Using a credit card helps you show that you’re good at borrowing and repaying money. This can help you get loans or rent places in the future.

- Pay in Parts: If you want to buy something expensive, you can put it on your credit card and pay a bit every month. It’s better than paying all at once or getting a costly personal loan.

- Rewards and Offers: Credit cards often give you rewards, like cash back or points. You can use these rewards to buy things or get discounts. Some cards even give you benefits like flight miles.

- Free Credit Period: For a short time, you don’t have to pay interest on your credit card bill. It’s like getting a loan without interest. But you must pay the whole bill before a certain date.

- Expense Tracking: Your credit card bill shows what you bought. This helps you keep track of spending and make budgets. The bank also sends alerts about your spending.

- Protection: If something you bought with the card is damaged or lost, the card might give you insurance. You can also prove what you bought using your card statement.

Disadvantages of Credit Cards:

- Minimum Due Trap: The least amount shown on the bill isn’t all you owe. If you pay only that, you’ll owe more over time, and it’s easy to spend more without realizing.

- Hidden Fees: Credit cards have extra charges like late fees and joining fees. If you miss payments, your credit score drops and you might pay more fees.

- Overusing Temptation: Since your bank balance doesn’t change, you might overspend and end up with debts you can’t pay back easily.

- High Interest: If you don’t pay your full bill, the rest carries over and gathers interest. Credit card interest is often high, like 3% per month or 36% per year.

- Fraud Risk: Sometimes, others can use your card without you knowing. Keep an eye on your bills for unusual purchases and tell the bank if you think someone’s using your card.

Remember, while credit cards have benefits, it’s important to use them wisely to avoid problems and debts.

1 thought on “Credit Card and Related Information”